LAST UPDATED: 6/28/19

Advanced Planning Tools and Financial Calculators

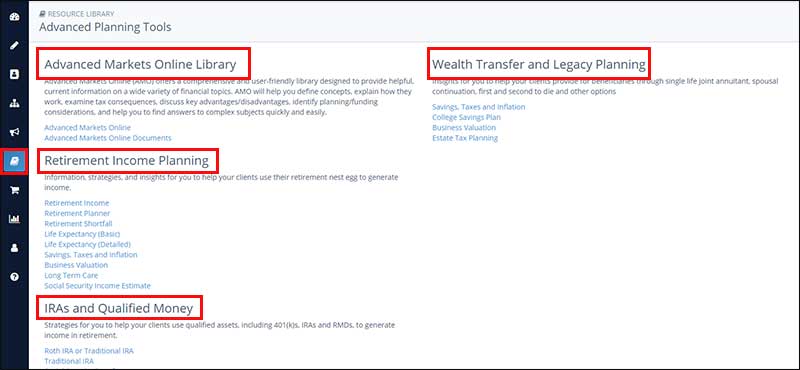

Located in the Resource Library, the Advanced Planning Tools tab is helpful if you need to brush up on planning solutions and techniques. This section offers a comprehensive and user-friendly library designed to provide helpful, current information on a wide variety of financial topics. It will help you define concepts, explain how they work, examine tax consequences, discuss key advantages/disadvantages, identify planning/funding considerations, and help you to find answers to complex subjects quickly and easily.

Jump to a section:

Access the Advanced Planning Tools & Financial Calculators

Display Troubleshooting

Available Tools & Calculators

Access the Advanced Planning Tools & Financial Calculators

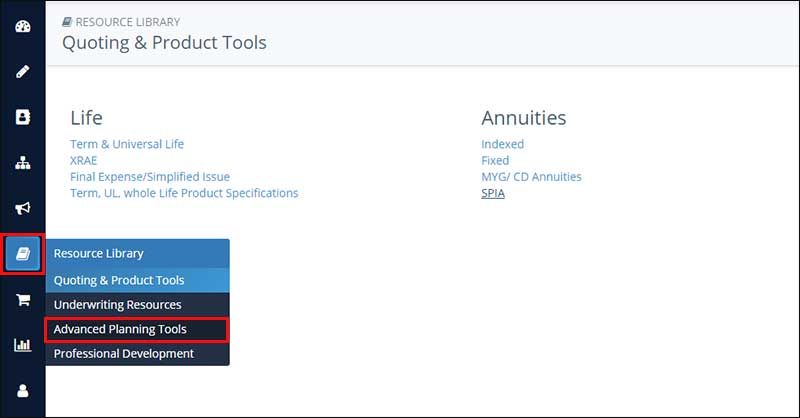

Hover your mouse over Resource Library and click Advanced Planning Tools from your left-hand main menu.

Here's what you'll see:

Display Troubleshooting

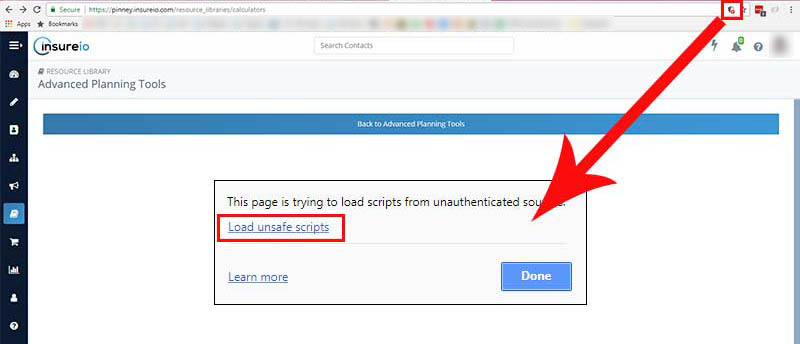

Did you click a link in this section and get a blank screen below the blue "Back to Advanced Planning Tools" bar? If so, this is due to a security setting in your browser. In Chrome, you can see the tiny security warning to the right of the address bar. Click that security icon, then click Load unsafe scripts.

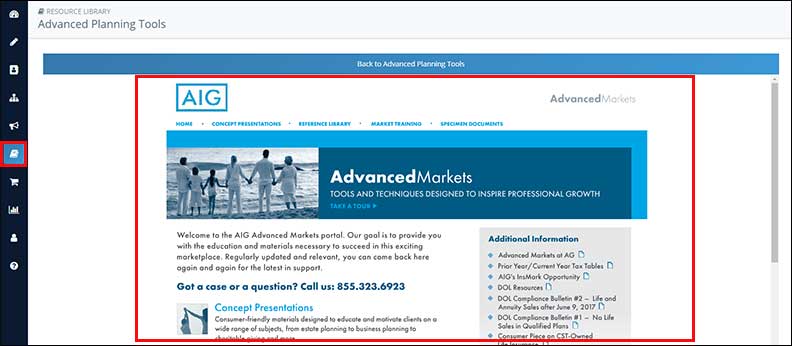

You'll be taken back to the Advanced Planning Tools and Financial Calculators page. Click your selection again and it will load within Insureio, like this:

Available Tools & Calculators

- Advanced Markets Online. In this section, you'll find a link to Advanced Markets Online, which offers a comprehensive and user-friendly library designed to provide helpful, current information on a wide variety of financial topics. AMO will help you define concepts, explain how they work, examine tax consequences, discuss key advantages/disadvantages, identify planning/funding considerations, and help you to find answers to complex subjects quickly and easily. No login information is necessary to view these materials.

- Advanced Markets Online Documents. In this section, you'll find a link to Advanced Markets Online Specimen Documents, which offers a comprehensive library of sample financial and legal documents you can share with a client or a client's attorney. From estate planning to retirement planning, business planning, and charitable giving, you'll find the documents you need here. No login information is necessary to view the sample documents.

- Wealth Transfer and Legacy Planning. This section offers insights for you to help your clients provide for beneficiaries through single life joint annuitant, spousal continuation, first and second to die and other options. Links include:

- Savings, Taxes, and Inflation. The value of your savings can be affected by both taxes and inflation. Use this calculator to determine how much your savings will be worth with this in mind. Click the "View Report" button to get more information and a year-by-year savings schedule.

- College Savings Plan. Saving for your children's education requires a long-term plan. And, like saving for retirement, the earlier you start your plan the better. Use this calculator to help develop or fine-tune your education savings plan. Click the "View Report" button for a detailed look at the results.

- Business Valuation. Business valuation is typically based on three major methods: the income approach, the cost approach and the market (comparable sales) approach. Among the income approaches is the discounted cash flow methodology – calculating the net present value ("NPV") of future cash flows for an enterprise. As an alternative to the more abbreviated income capitalization approach, this methodology is more relevant where future operating conditions and cash flows are variable – or not projected to be materially consistent with current performance levels.

- Estate Tax Planning. Estate tax planning is very important to preserving your wealth for future generations. Knowing your potential estate tax liability is a great place to start your estate tax plan. Use this calculator to project the value of your estate, and the associated estate tax, for the next ten years. This calculator uses the rules passed into law as part of the "Tax Hike Prevention Act of 2010". For 2011, this law reduces the maximum estate tax to 35% with the first $5,000,000 of an estate not subject to the tax. The new estate tax expires at the end of 2012 and without additional congressional action will revert back to the rules that were in place in 2001. Please be aware that certain estate planning documents, which are beyond the scope of this calculator, may be necessary in order for assets to be distributed according to your wishes.

Retirement Income Planning. Information, strategies, and insights for you to help your clients use their retirement nest egg to generate income.

- Retirement Income. Use this calculator to determine how much monthly income your retirement savings may provide you in your retirement. Your annual savings, expected rate of return and your current age all have an impact on your retirement's monthly income. View the full report to see a year-by-year break down of your retirement savings.

- Retirement Planner. Do you know what it takes to work towards a secure retirement? Use this calculator to help you create your retirement plan. View your retirement savings balance and your withdrawals for each year until the end of your retirement. Social security is calculated on a sliding scale based on your income. Including a non-working spouse in your plan increases your social security benefits up to, but not over, the maximum.

- Retirement Shortfall. One of the biggest risks to a comfortable retirement is running out of money too soon. This calculator helps you determine your projected shortfall or surplus at retirement. You can also see just how long your current retirement savings will last. If your results project a shortfall, you might need to save more, earn a better rate of return, or possibly delay your retirement.

- Life Expectancy (Basic). How much you need for retirement depends a great deal on how long you expect to live. This calculator can give you an idea of your life expectancy based on your current age, smoking habits, gender and several other important lifestyle choices.

- Life Expectancy (Detailed). Do you know your likelihood of living to age 70? 80? 90? The results may surprise you and help you plan your retirement. Complete the top portion of the calculator below for a general life expectancy estimate or complete both portions for a more precise estimate.

- Savings, Taxes, and Inflation. The value of your savings can be affected by both taxes and inflation. Use this calculator to determine how much your savings will be worth with this in mind. Click the "View Report" button to get more information and a year-by-year savings schedule.

- Business Valuation. Business valuation is typically based on three major methods: the income approach, the cost approach and the market (comparable sales) approach. Among the income approaches is the discounted cash flow methodology – calculating the net present value ("NPV") of future cash flows for an enterprise. As an alternative to the more abbreviated income capitalization approach, this methodology is more relevant where future operating conditions and cash flows are variable – or not projected to be materially consistent with current performance levels.

- Long Term Care. Long term care is needed by those who can't perform the basic tasks required to take care of themselves. This can include people suffering from a debilitating illness or chronic injury. The need for long term care can arise unexpectedly, often creating a large financial burden. This calculator can help you determine if you are financially prepared for this impending expense.

- Social Security Income Estimate. This will open up the SSA's Social Security Quick Calculator, to help you estimate a client's future benefits.

IRAs and Qualified Money. This section contains strategies for you to help your clients use qualified assets, including 401(k)s, IRAs and RMDs, to generate income in retirement.

- Roth IRA or Traditional IRA. An IRA can be an effective retirement tool. There are two basic types of Individual Retirement Accounts (IRA): the Roth IRA and the Traditional IRA. Use this tool to determine which IRA may be right for you. Please note that this calculator should not be used for Roth 401(k) comparisons.

- Traditional IRA. Contributing to a traditional IRA can create a current tax deduction, plus it provides for tax-deferred growth. While long term savings in a Roth IRA may produce better after tax returns, a Traditional IRA may be an excellent alternative if you qualify for the tax deduction.

- Social Security Benefits. Do you wonder how much you might receive in Social Security? Use this calculator to help you estimate your Social Security benefits. Remember, this is only an estimate. Your actual benefits may vary depending on your actual work history and income.

- 72(t) Calculator. Calculate early withdrawals from retirement accounts.

- 72(t) Distributions. Impact on Retirement Fund Balances. The Internal Revenue Code section 72(t) and 72(q) allows for penalty free early withdrawals from retirement accounts. The IRS limits how much can be withdrawn by assuming any future earnings will be at most 120% of the Federal Mid-Term. This conservative approach can help assure that you will not prematurely deplete your retirement account. However, if you have a higher rate of return your account can actually grow, even with your distributions. On the other hand, if you suffer losses your account balance may end up shrinking faster than you might expect. This calculator is designed to examine the affects of 72(t)/(q) distributions on your retirement plan balance.

- Pension Plan Retirement Options. Choosing between pension options can be a difficult task. Choosing an option that guarantees your spouse pension benefits after your death means extra security but also lower monthly benefits. On the other hand, choosing a pension option that only pays through your lifetime can provide larger monthly payments, but requires a lump sum to protect your spouse if she outlives you. Use this calculator to help decide which pension option works best for your particular retirement needs.

- Beneficiary Required Minimum Distribution. When you are the beneficiary of a retirement plan, specific IRS rules regulate the minimum withdrawals you must take. If you want to simply take your inherited money right now and pay taxes, you can. But if you want to defer taxes as long as possible, there are certain distribution requirements with which you must comply. Use this calculator to determine your Required Minimum Distributions (RMD) as a beneficiary of a retirement account.

- Required Minimum Distribution. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually, starting the year you turn age 70-1/2. Determining how much you are required to withdraw is an important issue in retirement planning. Use this calculator to determine your Required Minimum Distributions.